Best mortgage refinance rates 2025 set the stage for a smart financial move that can potentially save you thousands. As we delve into the intricacies of mortgage refinancing, discover how to navigate the complex world of interest rates and secure the best deal for your future.

Exploring the factors influencing rates, understanding the refinancing process, and comparing lenders’ offerings are just the beginning of this enlightening journey towards financial stability.

Researching Mortgage Refinance Rates

When considering mortgage refinance rates, it is essential to understand the various factors that can influence them. Economic indicators play a significant role in determining these rates, and the type of mortgage chosen can also impact the overall cost. Let’s delve into the details below.

Factors Influencing Mortgage Refinance Rates

- Current economic conditions, such as inflation rates and unemployment levels, can affect mortgage refinance rates. Lenders may adjust rates based on these factors to manage risks.

- The borrower’s credit score and financial history can also influence the interest rates offered for mortgage refinancing. A higher credit score typically leads to lower rates.

- The loan-to-value ratio, which compares the amount of the loan to the appraised value of the property, can impact refinance rates. Lower ratios may result in better rates.

Fixed-Rate vs. Adjustable-Rate Mortgages for Refinancing

- Fixed-Rate Mortgages: These mortgages offer stable interest rates throughout the loan term, providing predictability for monthly payments. They are a popular choice for borrowers seeking long-term consistency.

- Adjustable-Rate Mortgages (ARMs): ARMs have interest rates that can fluctuate over time based on market conditions. While initial rates may be lower than fixed-rate mortgages, there is a potential for increased payments in the future.

Understanding the Mortgage Refinancing Process

When considering mortgage refinancing, it is important to understand the process involved in order to make informed decisions that align with your financial goals.

Step-by-Step Guide on How to Refinance a Mortgage

- Evaluate Your Financial Situation: Assess your current mortgage terms, interest rates, and monthly payments to determine if refinancing is a viable option.

- Research Lenders and Rates: Compare mortgage refinance rates from various lenders to find the best offer that suits your needs.

- Submit an Application: Complete the refinance application with the necessary personal and financial information required by the lender.

- Appraisal and Underwriting: The lender will conduct an appraisal of your property and review your application to determine eligibility for refinancing.

- Closing: Once approved, you will sign the new loan documents, pay closing costs, and officially refinance your mortgage.

Documentation Required for a Mortgage Refinance Application

- Proof of Income: Recent pay stubs, tax returns, and other income documents.

- Asset Information: Bank statements, investment accounts, and other asset details.

- Property Information: Homeowners insurance, property tax information, and current mortgage statement.

- Credit Report: Lenders will pull your credit report to assess your creditworthiness.

Importance of Credit Scores in Securing the Best Refinance Rates

Maintaining a good credit score is crucial when refinancing a mortgage as it directly impacts the interest rate you qualify for. A higher credit score can help you secure lower refinance rates, saving you money over the life of the loan. It is recommended to review your credit report, address any discrepancies, and work on improving your credit score before applying for a mortgage refinance.

Comparing Lenders for the Best Rates

When looking to refinance your mortgage, it is crucial to compare lenders to ensure you are getting the best rates possible. Different lenders offer different rates and terms, so it’s important to shop around and find the best deal for your financial situation.

Reputable Lenders Known for Competitive Rates

- Quicken Loans

- Chase

- Bank of America

It is essential to research each lender’s reputation, customer service, and track record when considering mortgage refinance options.

Significance of Loan-to-Value Ratios in Lender Selection

- The loan-to-value (LTV) ratio is a crucial factor that lenders consider when offering refinance rates.

- Lenders typically offer better rates to borrowers with lower LTV ratios, as they are seen as less risky.

- Borrowers with high LTV ratios may face higher interest rates or additional fees.

It is important to understand your LTV ratio and work to improve it before applying for a mortgage refinance to secure better rates.

Negotiating with Lenders for Better Refinance Terms

- Shop around and get quotes from multiple lenders to leverage in negotiations.

- Highlight your strong credit history and financial stability to negotiate for lower rates.

- Consider paying points upfront to lower your interest rate over the life of the loan.

Remember that negotiating with lenders can help you secure better terms on your mortgage refinance, saving you money in the long run.

Forecasting Mortgage Rates for 2025

In order to anticipate the mortgage rates for 2025, it is essential to analyze the trends in mortgage rates leading up to that year. Various economic factors play a crucial role in determining the direction of mortgage rates, making it important to consider how these factors may influence rates in 2025. Additionally, expert opinions can provide valuable insights into the projected direction of mortgage rates for the upcoming years.

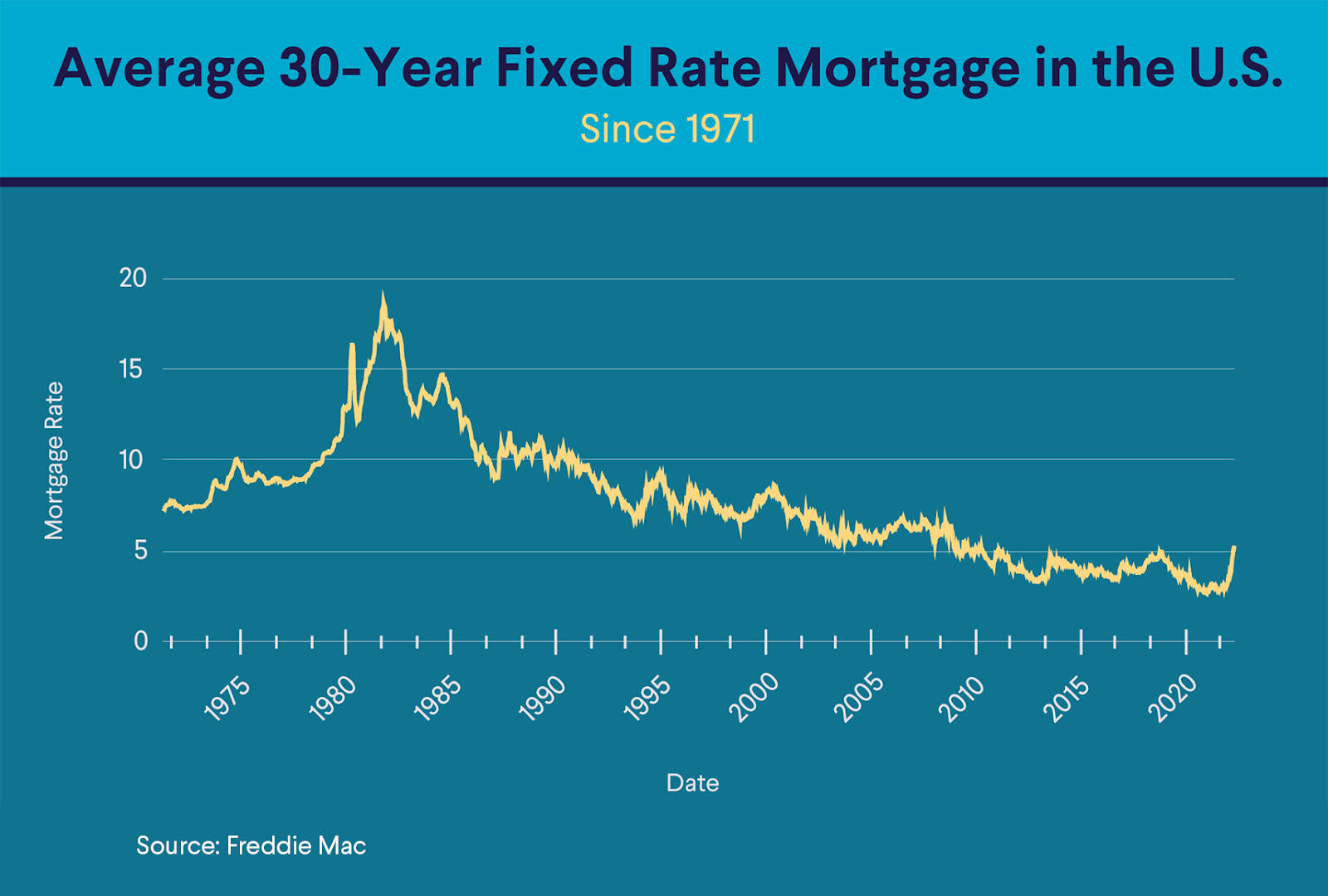

Trends in Mortgage Rates

Over the past few years, mortgage rates have fluctuated due to factors such as inflation rates, economic growth, and monetary policy. By examining these trends, we can gain a better understanding of how mortgage rates may evolve leading up to 2025.

Economic Factors Influencing Mortgage Rates in 2025

Economic factors such as employment levels, GDP growth, and inflation rates can significantly impact mortgage rates. It is crucial to consider how these factors may change in the coming years and their potential effect on mortgage rates in 2025.

Expert Opinions on Projected Direction of Mortgage Rates

Industry experts and economists often provide forecasts on the direction of mortgage rates based on their analysis of economic indicators and trends. By taking into account these expert opinions, we can gain valuable insights into the potential trajectory of mortgage rates in 2025.

Factors Impacting Mortgage Rates

In order to understand mortgage refinance rates for 2025, it is crucial to examine the various factors that can impact these rates. Factors such as inflation, the role of the Federal Reserve, and global events all play a significant role in determining mortgage rates.

Inflation and Mortgage Refinance Rates

Inflation can have a direct impact on mortgage refinance rates. When inflation is high, lenders may increase interest rates to compensate for the decrease in purchasing power of the dollar. This can result in higher mortgage rates for borrowers looking to refinance their loans.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in setting interest rates, which in turn can influence mortgage rates. By adjusting the federal funds rate, the Federal Reserve can control the cost of borrowing money. Changes in the federal funds rate can lead to fluctuations in mortgage rates, impacting borrowers seeking to refinance their mortgages.

Global Events and Domestic Mortgage Rates

Global events, such as economic crises, political instability, or natural disasters, can also influence domestic mortgage rates. These events can affect the overall economy, leading to changes in interest rates and mortgage rates. Borrowers considering mortgage refinancing should stay informed about global events that could potentially impact mortgage rates in 2025.

Calculating the Cost of Refinancing

When considering mortgage refinance options, it’s essential to calculate the cost involved in the process. This includes understanding closing costs, fees, and potential savings that can result from refinancing your mortgage.

Comparing Closing Costs

- Obtain Loan Estimates: Request loan estimates from different lenders to compare closing costs, including application fees, origination fees, appraisal fees, title search, and other expenses.

- Create a Comparison Table: Design a table listing the closing costs from each lender to identify the most cost-effective option.

- Consider Discount Points: Evaluate the option to pay discount points to lower your interest rate, factoring in how long it will take to recoup the cost through monthly savings.

Calculating Potential Savings

- Estimate Monthly Payments: Use a mortgage calculator to determine the new monthly payments after refinancing based on the loan amount, interest rate, and term.

- Subtract Costs from Savings: Calculate the total cost of refinancing by subtracting the closing costs from the total savings over the life of the loan to determine if refinancing is financially beneficial.

- Consider Breakeven Point: Identify the breakeven point, where the monthly savings surpass the cost of refinancing, indicating when you will start to benefit from the new loan.

Fees Associated with Refinancing

- Origination Fees: Lender charges for processing the loan, typically 1% of the loan amount.

- Appraisal Fees: Cost for assessing the property’s value, around $300 to $500.

- Title Search and Insurance: Fees for verifying ownership and obtaining title insurance, averaging $700 to $900.

- Prepayment Penalties: Check for any penalties for paying off your existing mortgage early, impacting the cost of refinancing.

Tips for Securing the Best Refinance Rates

When looking to secure the best refinance rates for your mortgage, there are several strategies you can employ to increase your chances of getting a favorable deal. From improving your credit score to shopping around for offers, these tips can help you save money in the long run.

To start, consider the following tips for securing the best refinance rates:

Improving Credit Scores

- Pay down existing debt to lower your credit utilization ratio.

- Make all payments on time to establish a positive payment history.

- Check your credit report for errors and dispute any inaccuracies.

Shopping Around for Refinance Offers

- Request quotes from multiple lenders to compare rates and fees.

- Negotiate with lenders to see if they can offer better terms.

- Consider working with a mortgage broker to access a wider range of options.

Timing the Refinance

- Monitor mortgage rate trends and refinance when rates are low.

- Avoid refinancing too soon after taking out your original mortgage.

- Factor in closing costs and how long you plan to stay in your home.

Types of Mortgage Refinance Options

When considering mortgage refinance, borrowers have various options to choose from based on their financial goals and circumstances. It is important to understand the different types of refinance options available to make an informed decision.

Cash-Out Refinance vs. Rate-and-Term Refinance

- A cash-out refinance allows homeowners to refinance their mortgage for more than they currently owe and receive the difference in cash. This type of refinance is beneficial for those looking to access their home equity for large expenses such as home renovations or debt consolidation.

- On the other hand, a rate-and-term refinance involves refinancing your existing mortgage for a better interest rate or loan term without taking out additional cash. This option is ideal for borrowers looking to lower their monthly payments or pay off their loan faster.

Eligibility Criteria for Government-Backed Refinance Programs

- Government-backed refinance programs such as FHA, VA, and USDA streamline refinance options have specific eligibility criteria that borrowers must meet. For example, FHA streamline refinances require borrowers to have an existing FHA loan and be current on their mortgage payments.

- VA streamline refinance, also known as Interest Rate Reduction Refinance Loan (IRRRL), is available to veterans and active-duty military personnel with an existing VA loan. USDA streamline refinance is designed for borrowers with existing USDA loans.

Pros and Cons of Refinancing into a Shorter Loan Term

- Refinancing into a shorter loan term can help borrowers save on interest payments over the life of the loan and build home equity faster. Additionally, shorter loan terms typically come with lower interest rates.

- However, refinancing into a shorter loan term may result in higher monthly payments, which could strain your budget. It is important to carefully consider your financial situation and long-term goals before opting for a shorter loan term.

Risks Associated with Refinancing

Refinancing your mortgage can offer significant benefits, but it’s essential to be aware of the potential risks involved. Understanding these risks can help you make informed decisions when considering a refinance.

Prepayment Penalties Impact

- Some lenders may charge prepayment penalties if you pay off your mortgage early through refinancing.

- These penalties can offset the savings you would gain from lower interest rates.

- It’s crucial to review your current mortgage terms to determine if prepayment penalties apply before deciding to refinance.

Risks of Adjustable-Rate Mortgages

- Refinancing into an adjustable-rate mortgage (ARM) can come with risks due to potential interest rate fluctuations.

- If interest rates rise significantly after refinancing into an ARM, your monthly payments could increase substantially.

- Consider your financial stability and long-term plans before opting for an ARM through refinancing.

Impact of Market Trends on Refinance Rates

When it comes to mortgage refinance rates, market trends play a significant role in determining the interest rates offered to borrowers. Understanding how housing market trends, mortgage-backed securities, and unemployment rates can impact refinance rates is crucial for homeowners looking to refinance their mortgages.

Housing Market Trends

The housing market trends, such as home prices, inventory levels, and demand for housing, can influence refinance rates. In a strong housing market where home prices are rising, lenders may offer lower refinance rates to attract borrowers. Conversely, in a sluggish market with declining home prices, refinance rates may be higher as lenders try to mitigate their risks.

Mortgage-Backed Securities

Mortgage-backed securities (MBS) are investment products that are backed by a pool of mortgages. The performance of MBS in the secondary market can impact refinance rates. When investors have high demand for MBS, it can lead to lower refinance rates for borrowers. On the other hand, if there is low demand for MBS, lenders may raise refinance rates to attract investors.

Unemployment Rates

Unemployment rates can also have an impact on mortgage refinance terms. In times of economic uncertainty or high unemployment, lenders may tighten their lending criteria and raise refinance rates to offset potential risks. Conversely, when unemployment rates are low and the economy is strong, lenders may offer more competitive refinance rates to attract borrowers.

Long-Term Financial Planning with Refinancing

Refinancing can play a crucial role in long-term financial planning by helping homeowners save money over the life of their loan. By securing the best refinance rates, individuals can potentially reduce their monthly payments and overall interest costs, freeing up funds for other financial goals.

Maximizing Long-Term Savings

- Compare lenders to ensure you are getting the lowest possible interest rate. Even a small percentage difference can translate to significant savings over the years.

- Consider different loan terms and options to find the most suitable one for your financial situation. Shortening the loan term can result in substantial interest savings.

- Use a refinance calculator to estimate your potential savings and determine if refinancing is the right choice for you.

Reinvesting Savings for Financial Goals

- Allocate the savings from refinancing towards building an emergency fund or retirement savings account to secure your financial future.

- Consider paying off high-interest debt to further improve your financial health and reduce overall interest expenses.

- Invest the savings in a diversified portfolio to potentially earn higher returns over time, contributing to long-term wealth accumulation.

Closure

In conclusion, the quest for the best mortgage refinance rates in 2025 unveils a world of possibilities for homeowners seeking to optimize their financial strategies. By leveraging the insights gained from this discussion, you can make informed decisions that pave the way for a more secure financial future.